In June 2014, the Congressional Budget Office (CBO) published an analysis of the feasibility and economic implications of achieving future annual renewable fuel mandate volumes[1] for the federal Renewable Fuels Standard (RFS). Here in Regulation City, refining industry advocates praised the CBO analysis; ethanol industry advocates trashed it. Elsewhere, the report attracted little attention. That’s too bad, because CBO has made an important contribution to the coming debate over the RFS.

The CBO report (1) lays out the amount by which supplies of the various RFS renewable fuel categories would have to increase to meet the RFS mandate volumes for 2017, (2) assesses the technical feasibility of producing these volumes, and (3) estimates the effects on RIN prices, gasoline and diesel fuel prices, food prices, and CO2 emissions. The analysis covers three assumed RFS regulatory scenarios:

- EISA Volumes: In this scenario, fuel suppliers meet EISA’s 2017 mandate volumes for total renewable fuels, advanced biofuels (comprising biomass-based diesel and other advanced biofuels, such as sugar cane ethanol). Using the discretion granted it by EISA, EPA sets the 2017 mandate volume for cellulosic ethanol commensurate with the small volume of cellulosic ethanol supply likely to be available in 2017.

- 2014 Volumes: In this scenario, EPA uses its statutory discretion to maintain – at least through 2017 – its proposed (but not yet final) 2014 mandate volumes for renewable fuels, advanced biofuels, biomass-based diesel, and cellulosic biofuel. (EPA’s proposed 2014 mandate volumes are already somewhat lower than the 2014 EISA volumes.)

- RFS Repeal: In this scenario, Congress abolishes the RFS. Fuel suppliers continue to use ethanol (and bio-diesel) to the extent economically justified.

Of these scenarios, CBO deemed 2014 Volumes the most likely.

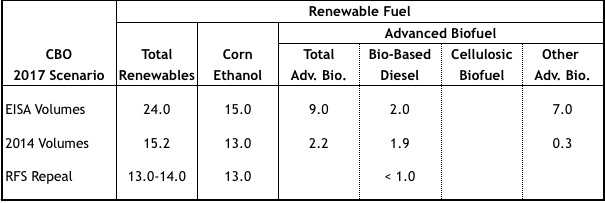

The mandate volumes specified by CBO for each scenario are shown below.[2]

EISA Volumes requires fuel suppliers to use about 9 bgy more renewable fuel in 2017 than 2014 Volumes and about 11 bgy more than RFS Repeal.

The headline finding of CBO’s analysis is that achieving the various renewable volumes in EISA Volumes — the statutory requirement — poses “significant challenges.”

CBO notes that the supply of cellulosic biofuel (i.e., cellulosic ethanol) has been negligible (< 0.01 bgy) since the inception of the RFS, and (according to projections by the U.S. Energy Information Administration and others) will continue falling far short of the mandate volumes through 2022 and beyond. Biomass-based diesel and other advanced biofuels (e.g., sugar cane ethanol imported from Brazil) cannot offset this shortfall, for both economic and statutory reasons.

At the same time, the existence of the E10 blend wall, coupled with the projected decline in U.S. gasoline consumption, means that achieving the renewable fuel mandate volumes would entail increased production and use of some combination of E85, bio-mass based diesel, and “drop-in” cellulosic biofuels[3].

CBO concludes that full compliance with the 2017 EISA volume mandates would require both

- A rapid (i.e., occurring in < 3 years) and large (≈ 7 bgy) increase in advanced biofuels supply, including both a > 100% increase in U.S. biomass-based diesel production and a 45% increase in Brazil’s sugar cane ethanol production (with a 4-fold increase in Brazilian exports); and

- A ≈ 40-fold increase in E85 use – requiring rapid, synchronized, and large increases in E85 production, ethanol logistics capacity, the number of retail outlets offering E85, and the FFV share of the vehicle fleet.

Using reasonable economic assumptions, CBO concludes that attaining the EISA 2017 mandate volumes – if that were feasible – would have significant effects on retail fuel prices. CBO estimates that (all else equal) attaining the EISA mandate volumes would cause

- Diesel prices to increase by $0.30–$0.51/gal

- E10 prices to increase by $0.13–$0.26¢/gal

- E85 prices to decrease by $0.91–$1.27¢/gal[4]

These estimated fuel price effects follow from CBO’s estimates of the RIN prices that would result from attaining the EISA 2017 mandate volumes:

- Renewable fuel RINs: $1.55–$2.10

- Advanced biofuel RINs: $3.00–$6.00

- Biomass-based diesel RINs $3.00–$6.00

The RFS program still seems to enjoy Congressional support, leaving EPA with the task of reconciling ever-increasing mandate volumes with the hard constraints that restrict renewable fuel production and usage. EPA’s struggles are such that it has yet to issue its final rules governing RFS volume obligations for 2014, let alone for 2015 (both now overdue). EPA now promises to issue its final rules covering 2014, 2015, and 2016 volume obligations in late 2015. Perhaps they will. But sooner or later, facts and numbers will force Congress to revisit the RFS program.

CBO’s findings are important contributions to that RFS debate – not because they are novel (other analyses have yielded similar findings) or because reaching them requires any deep methodology (simple arithmetic based on subject-area knowledge is all that’s required). They are important because they come from CBO, a non-partisan and competent source of objective information and analysis.[5]

[1] These mandates were established in the Energy Independence and Security Act of 2007 (EISA). The mandate volumes apply to renewable fuels, advanced biofuels, biomass-based diesel, and cellulosic ethanol, and increase annually out to 2022.

[2] As the table indicates, the cellulosic biofuel and biomass-based diesel volumes are components of the advanced biofuel volume, which in turn is a component (along with corn ethanol) of the total requirement for renewable fuels.

[3] “Drop-in” biofuels are biofuels that are hydrocarbons rather than oxygenated compounds (such as ethanol) and therefore can be commingled with – dropped into – refinery produced gasoline without regard for the E10 blend wall. No “drop-in” biofuels are available in commerce as yet.

[4] The E85 price decrease reflects CBO’s estimate of the discount against the E10 price that consumers would require in order to be willing to buy E85. E85 could generate these discounts by selling the excess renewable fuel RINs generated by blending ethanol in excess of the renewable volume obligation.

[5] Perhaps that’s why the Advanced Ethanol Council said of the CBO report, “Some reports are simply not worth reading, and this is one of them.”